Our Services

Financial Services

Today, finance has become an international business rather than a domestic service. Private or legal persons operating anywhere in the world can borrow money from a financial institution anywhere in the world if they meet the necessary conditions. The fact that this borrowing provides the highest level of profitability for both parties is the only point that unites the parties.

Swiss Financial Consultancy & Audit Inc. (SFCA AG) is an auditing and financial consultancy firm operating in many parts of the world, established in Switzerland / Zurich by professionals working in the field of finance and international trade for more than 20 years. Our company is not a "Intermediary Institution", "Bank" or "Finance Institution", it is a Consultancy firm. The aim of the company is to assist the private or legal persons receiving services from banks, funds or similar structures in order to provide them with the opportunity to borrow on the most favorable terms.

Swiss Financial Consultancy & Audit Inc. It determines the credit score by auditing the financial structures of the people it serves and prepares the "Application File" for its customers to use in their loan applications. It carries out the process from the submission of the file to the relevant financial institution, until the application is evaluated, and the result of the loan is determined, and if approved, the requested amount will be transferred to the account.

Swiss Financial Consultancy & Audit Inc. It processes at least 1 million CHF loan applications.

What is financial advisory?

Financial advisory is a professional service that provides individuals or businesses with advice and guidance on financial matters.

The primary aim of financial advisory is to help clients manage their money more effectively and make informed decisions about investments, retirement planning, taxation, risk management, and other financial matters.

Financial advisors typically work with clients to assess their financial goals and objectives, and then develop a personalized financial plan to help them achieve those goals. This may involve analyzing a client's current financial situation, recommending appropriate investment strategies, and providing ongoing support and advice to help clients stay on track.

Financial advisory services can be provided by various professionals, including financial planners, investment advisors, wealth managers, and tax advisors. The type of advisor a client chooses will depend on their specific financial needs and goals, as well as their personal preferences and budget.

What are the types of Financial Advisory?

There are several types of financial advisory services that individuals or businesses can choose from, depending on their specific financial needs and goals. Here are some of the most common types of financial advisory:

1. Investment advisory:

This type of advisory service focuses on providing investment recommendations and portfolio management services to clients based on their investment objectives and risk tolerance.

2. Wealth management:

Wealth management is a comprehensive financial advisoryw service that covers all aspects of a client's financial life, including investment management, tax planning, retirement planning, estate planning, and risk management.

3. Financial planning:

Financial planning services help clients develop a comprehensive financial plan that outlines their financial goals and provides a roadmap to achieve them. This includes budgeting, saving, investing, retirement planning, tax planning, and estate planning.

4. Retirement planning:

Retirement planning advisory services focus on helping clients plan for their retirement by developing a strategy for saving, investing, and managing their finances during retirement.

5. Tax advisory:

Tax advisory services help clients minimize their tax liability by providing advice on tax planning strategies, tax-efficient investments, and tax compliance.

6. Risk management:

Risk management advisory services help clients identify and manage financial risks, including market risks, credit risks, and operational risks.

7. Corporate finance:

Corporate finance advisory services provide advice and support to businesses on a range of financial matters, including mergers and acquisitions, capital raising, financial restructuring, and corporate governance.

It's important to note that some financial advisors may offer multiple types of advisory services, while others may specialize in a specific area. It's important to choose an advisor whose expertise and services align with your specific financial needs and goals.

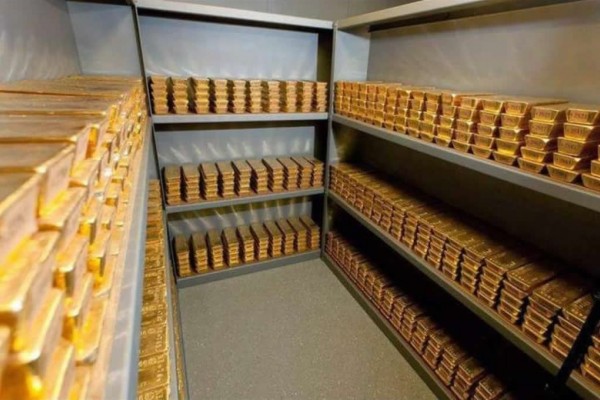

International Metal Commodity Trade

Swiss Financial Consultancy & Audit Inc. (SFCA AG) iron, copper, aluminum etc. processed or supplied to the markets as scrap. offers many metal commodities to its customers in the most reliable way and provides mediation services in this regard. SCFA especially works on Cathode, Millbery Scrap Copper Wire, Rail Scrap, Aluminum products. It supplies all kinds of metal commodities requested from various parts of the world in line with the demands of its customers.

Metal is a trade made with very large budgets since it is realized in commercial high tonnages. There are many topics that cause hesitation in making this trade, such as the correct chemical and physical properties of the contracted metal commodity in accordance with the contract, the reliable payment methods, the continuous and timely supply of goods.

SFCA AG provides consultancy to its customers (Buyers and Sellers) in establishing the right business relationship and operating it in accordance with the rules of the signed contract. The aim of our company in metal commodity trade is to bring the right buyers and sellers together to ensure safe and correct trade.

Import - Export Consultancy

Companies operating in many parts of the world have made reliable trade in their import or export processes their top priority. Especially when it comes to developing country markets. It offers many commercial advantages for countries that want to both sell products to these countries and buy finished products, semi-finished products or raw materials from these countries. The biggest difficulty in trading with these countries is the risks that may be encountered if the buyers or sellers do not act in commercial ethics.

Thanks to its international connections, SFCA AG provides products with the most advantageous prices in many different countries in line with the demands of its customers and carries out consultancy activities for the realization of trade in reliable conditions.

Construction

Although SFCA AG was established in 2008, its founders have been operating in the construction industry in Switzerland since 1993. SFCA AG has focused its work on demolition, historic building restorations, and building renovations. SFCA AG, which has successfully carried out many public projects in the restoration processes of historical buildings in accordance with their originality, is among the leading companies in the sector, especially in quality works in this field. SFCA AG carries out its construction activities only in Switzerland. SFCA AG provides references in its business lines only if requested and allowed by previous customers.